THE CHALLENGE

Designing a cutting-edge, online-only bank for milennials

Designing a cutting-edge, online-only bank for milennials

Selfies, job-hopping, and persistent optimism: the classic millennial descriptors don’t get at the genuine values and behaviours that drive Generation Y’s decision making. So when a London-based global finance house set out to design a cutting-edge, online-only bank for HK millennials, they knew they needed to cut deeper than the pop culture memes about today’s 20 to 35 year olds. They turned to Heist to get the insights needed to design a fit-for-future bank.

What resulted was a blueprint for the design and development of a new kind of online financial experience. Extending out from the obvious trends related to spending, saving, and investment behaviours, Heist delved into the lifestyles of young Hong Kongers, learning firsthand about their values and beliefs related to technology, social influence and lifestyle – the underlying drivers of why they choose one banking experience over another.

Heist’s insights represent the bedrock of the bank’s understanding about their target market, which will serve as the testbed for a planned regional expansion. Throughout its design, Heist’s opportunity areas remain the reference point for how features will fit into consumers’ day-to-day life, and the grounding for creating ‘sticky’ systems that reward customers for loyalty – a hard-to-design-for trait in the highly optimised world of Millennials.

Co-creation – with the bank client and Hong Kong-based Millennials – was a project theme. After identifying what a digital bank means for different parts of a person’s life, Heist prompted each of the 50+ in-person interviewees to sketch out the online service they’d like to see, and describe why this service fulfilled their needs.

Heist shared these concepts with the bank’s senior leadership team, and together, they created a set of criteria for evaluating ideas: They must be profitable, connected to a real user need, and able to be built in 6-8 months. Ideas were further built upon in an internal, 50 employee workshop, and 7 of the ideas are now in development, slated to be a part of the new bank, which is targeted to launch in Q4 2018.

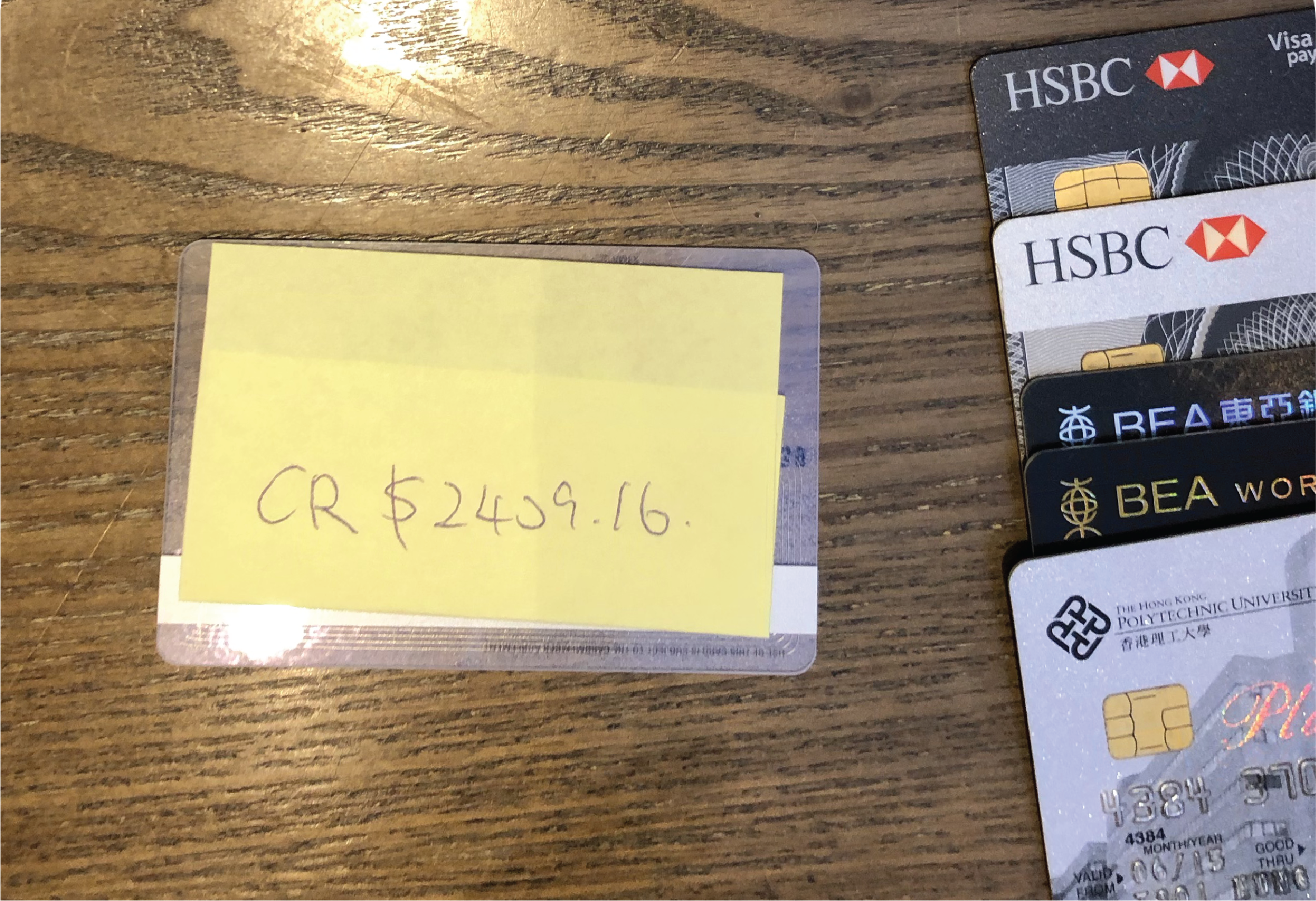

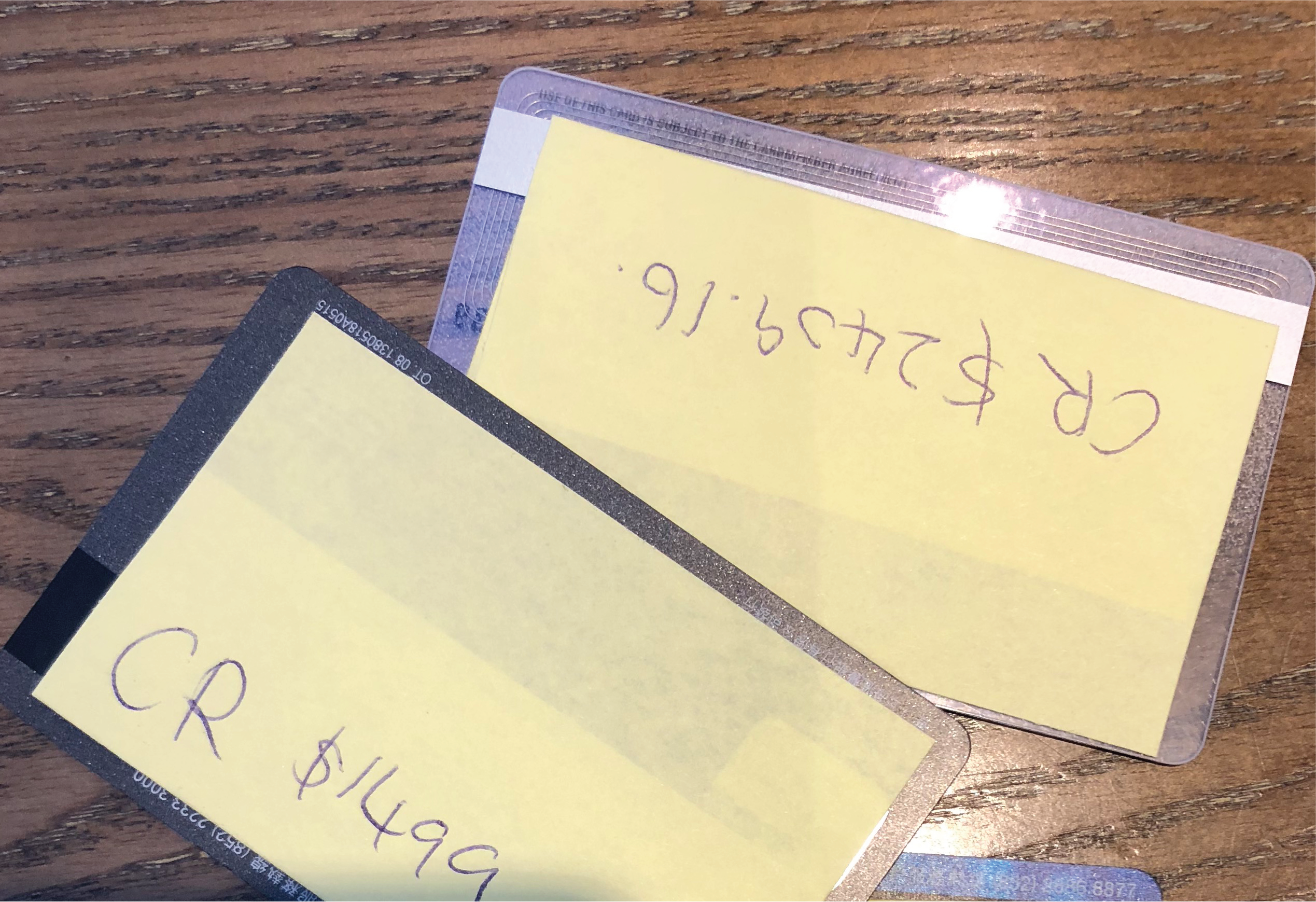

User statement: “I use Post-It notes at the back of my credit cards to keep track of refunds and balances.”

Insight: For Millennials in Hong Kong, visibility = control. Multiple channels for viewing online balances and a plethora of payment modes makes it tough to have a real-time understanding of overall financial health. For some, the tangibility of pen and paper is the only trustworthy view into accounts.

HMW: How might the bank make it as easy to see balances as it is to check a Snapchat account?

User statement: “My girlfriend said, ‘If you sign up for this credit card, you instantly get enough miles to fly to Singapore, and then you can cancel the card.’

Insight: In the minds of young Hong Kongers, gaming rewards systems is what smart people do. Multiple credit cards – for the sign-up benefits, not the credit limits – is considered savvy, and “what smart people do.”

HMW: What might a rewards system look like that encourages people to play the game?

User statement: “Each time I go to the ATM, I only withdraw HKD 500 – this helps me manage my spending.”

Insight: In a world of plastic and online transactions, money can feel as if it flies out the window, and people design their own systems to control their impulses.

HMW: How might the bank help people reign in their negative spending behaviors, and reward healthy financial decision-making?

Curious where Heist can take you? Call us today.